TAKING LEGAL ACTION TO RECOVER DEBTS

The prospect of taking a client to court to over unpaid debts is not an easy step for any business to contemplate. For a start it shows that the relationship between both parties has pretty well broken down. This could be due to a variety of reasons including poor communication; unrealistic expectations on the client’s behalf; client financial difficulties; or the client deliberately withholding payment because of a disagreement or policy to delay payment whenever possible. Whatever the reason, the FINAL recourse is to take legal action to recover the money owed.

In mainland UK we have 2 legal systems and this also applies when trying to recover debts. If you live in Scotland you can use the English online system, however, for some reason you must have a postal address in England where court documents can be sent. You do not need to be resident there; it could be a relative or friend’s address.

Be warned. The registration process for CCJs is also separate. So, if a Scottish company were awarded a judgement in a Scottish Court against an English-based company, the CCJ would not appear in their online records available from Companies House in England. This means that Scottish claimants can have less leverage against English defaulters (unless they use the English Small Claims Court).

SCOTLAND

For amounts up to £750 you can use the Small Claims Court.

For amounts over £750 but under £1500 you will need to raise a Summary Cause in the Sheriff Court.

At present you have to do all the form filling manually. The forms are available from your local Sheriff Court.

The following link will take you to the Scottish Sheriff Courts’ web site.

ENGLAND & WALES

South of the border the system for making small claims is available online. It is very straightforward and relatively easy to use. You can monitor the progress of your claim and instruct at various stages whether to proceed or not.

GENERAL

Taking legal action is a stressful business. Make sure you have a written schedule of telephone calls requesting payment, letters and/or faxes. This helps to clarify the exact sequence in your mind when completing forms. If you really can’t face all the hassle and stress then use a specialist debt collection company.

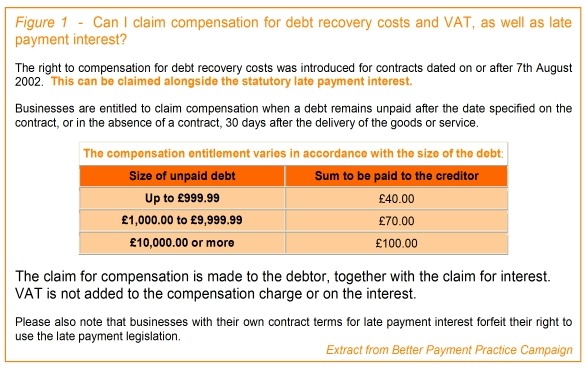

Legally you are entitled to claim statutory interest, plus legal costs. You must, however, inform the debtor in a recorded delivery letter that you intend to follow this course of action.

The following is a useful site for calculating statutory interest on debts:

http://www.payontime.co.uk/calculator/statutory.html

A letter requesting payment and notifying debtor that interest and compensation will be charged (see also Figure 1):

http://www.payontime.co.uk/collect/Business_Letter_post.html

A users guide to late payment legislation

http://www.payontime.co.uk/downloads/late_payment_brochure.pdf

The following is a useful site for checking the details of companies and also Directors (see also Companies House web site – doesn’t give Director’s details but is useful to find out if someone is disqualified):

https://secure.creditgate.com/index.aspx

http://wck2.companieshouse.gov.uk/e14b57c5836e1bf95237cfca36bdccfe/wcframe?name=accessCompanyInfo

Having CCJs does not mean that a company cannot trade or that a Director will be disqualified; however, it does make the business community aware of their credit worthiness.

The above is a general guide only and things may have changed since this was written. Please ensure that you do as much research as possible before embarking on legal action.

Remember that the money owed is rightfully yours. If you let debtors get away with non or very late payment because you cannot be bothered you might as well just work for free. Encouraging debtors through inaction is also bad news for other suppliers.